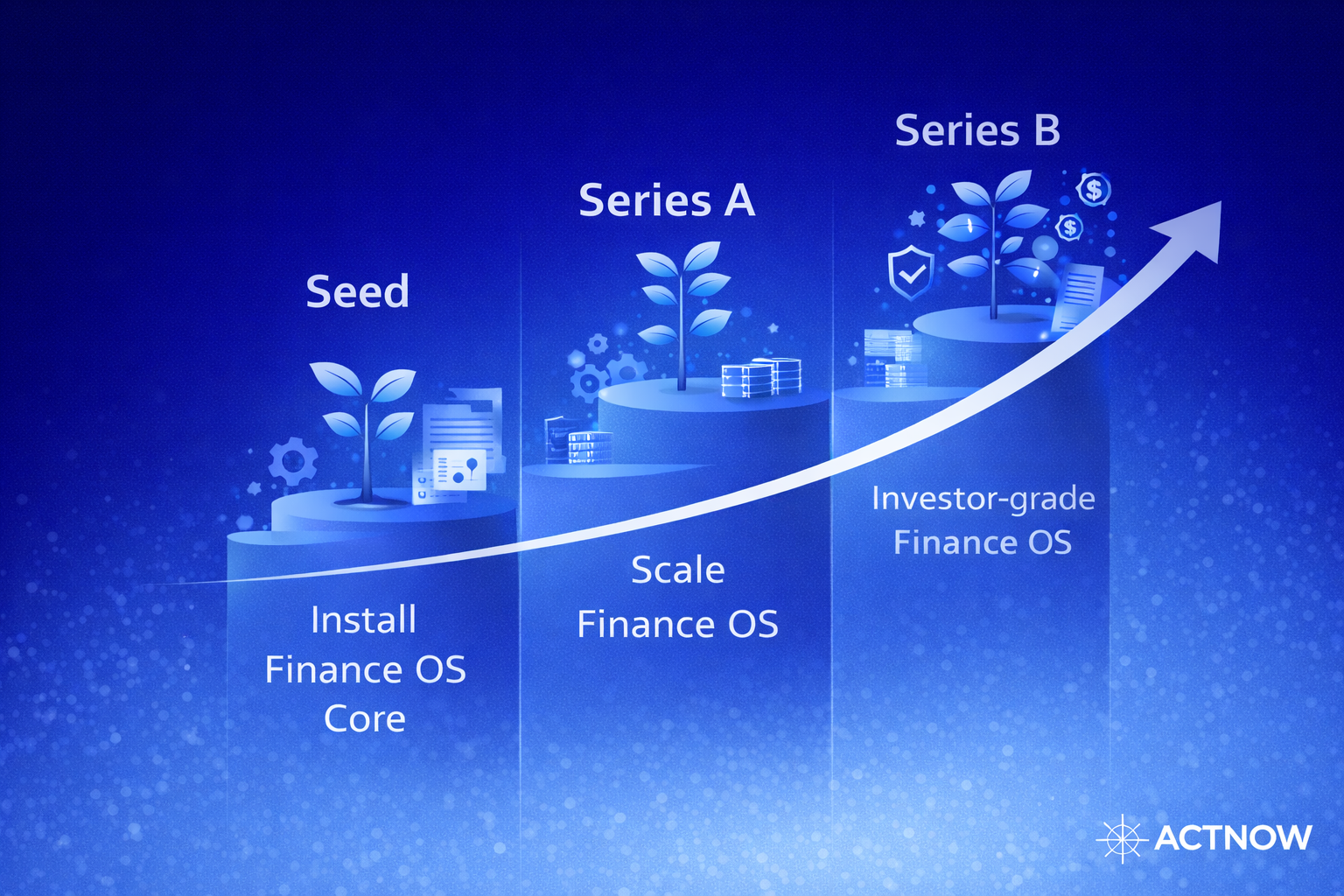

Finance OS™ - CFO-grade finance outcomes for VC-backed startups — from Seed to Series B

Finance OS™ is Actnow’s proprietary operating standard for modern startup finance.

You get clarity, control, and confidence — without founder dependency or finance jargon.

Outcomes founders get to see

No heavy theory. We install the operating rhythm and keep it running.

Most startups don’t fail because they lack ambition. They fail because finance becomes reactive: unclear runway, inconsistent reporting, and founder-dependent approvals.

Actnow installs and runs Finance OS™—our proprietary operating system (methodology) for finance—so you get clarity, control, and investor-ready outputs without building a full in-house team.

Finance OS™ gives you three things:

Runway Clarity

Know your burn, cash position, and runway — always current, always explainable.

Close Consistency

A disciplined monthly close and reporting cadence that doesn’t collapse when you’re busy.

Decision Control

Clear approvals, clean exceptions, and simple governance so spending stays intentional.

Same premium standard. Scaled to your stage.

Choose your stage. If you’re between stages, we’ll align the scope in the first call.

What we do at each stage

A simple view of the finance backbone, scaled as you grow.

Seed — Install the Finance OS™ backbone

For teams moving fast. We install control without slowing you down.

Focussed services:

-

Runway & cash discipline (weekly cash check + burn awareness)

-

Clean monthly close rhythm (simple, repeatable)

-

Investor-ready reporting baseline (metrics + narrative)

-

Vendor, invoice, and payment hygiene (no chaos)

-

Basic governance: approvals + exceptions (founder doesn’t carry everything)

Series A — Scale visibility and forecasting discipline

For teams hiring quickly and increasing spend. We keep your numbers decision-ready.

Focussed services:

-

Forecasting & scenarios (base / upside / downside)

-

Budget vs actuals with spend governance

-

KPI cadence tailored to your business model

-

Close + reporting strengthened (faster, cleaner, more consistent)

-

Founder & leadership decision support (simple, direct, documented)

Series B — Optimize control, predictability, and investor confidence

For teams with complexity. We make your finance function dependable at scale.

Focussed services:

-

Multi-entity / multi-currency readiness (where applicable)

-

Performance management rituals (targets, variance, accountability)

-

Stronger controls + audit-readiness (clean evidence, clean trail)

-

Finance-ops efficiency improvements (less manual work, fewer errors)

-

Board and investor confidence pack (numbers + narrative)

Finance OS™ is the system behind the service

Finance OS™ isn’t a document or a dashboard. It’s how we run your finance function like an operating system — so it works reliably every month.

Clarity — One source of truth for cash, burn, runway, and metrics.

Control — Approvals, exceptions, and evidence so nothing “slips through.”

Confidence — Reporting and decision support that investors trust.

What you receive every month

Clear numbers + clear narrative — designed for founders, not finance teams.

-

Runway & cash snapshot (simple and explainable)

-

Close summary + key movements

-

KPI dashboard tailored to your business

-

Budget vs actuals + spend highlights

-

Risks, decisions needed, and next actions

Outputs stay consistent; depth increases by stage.

Frequently Asked Questions

Ready to run finance like an operating system?

If you’re a VC-backed startup from Seed to Series B, Finance OS™ gives you clarity, control, and confidence — month after month.